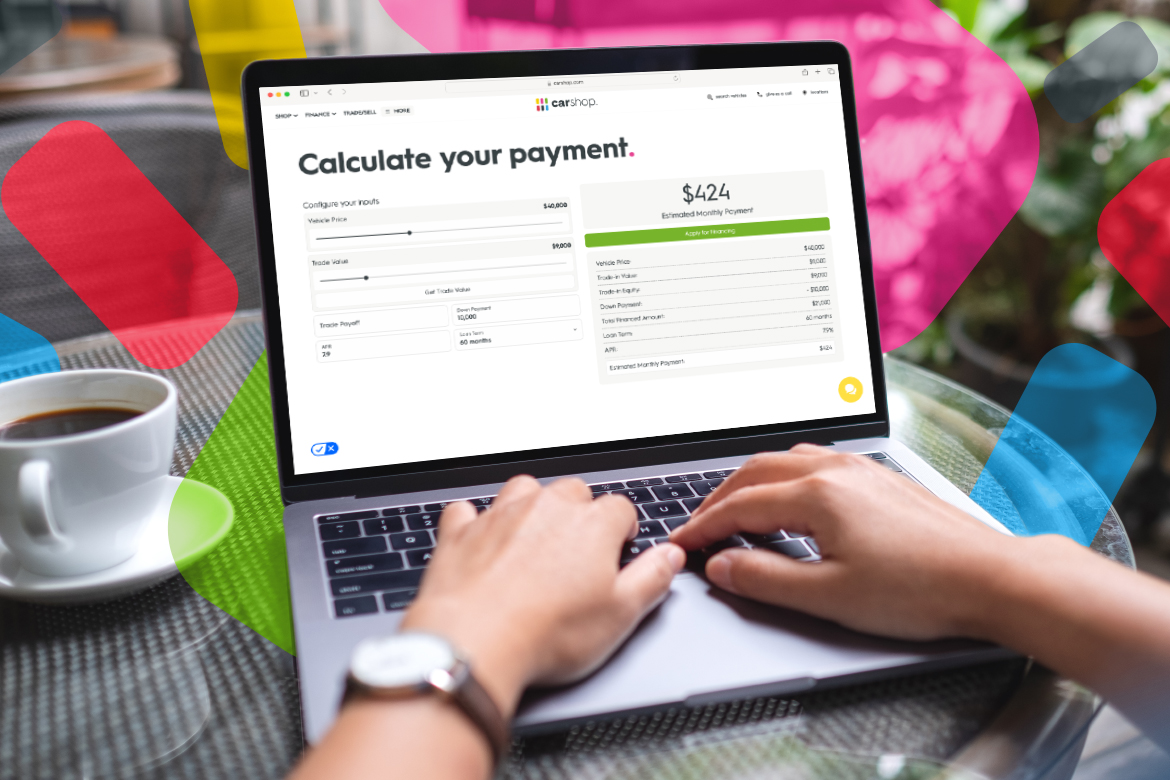

At CarShop, we make every step of getting your next vehicle simple and straightforward. We know that figuring out finances is extremely important in that process, and that one of your biggest questions will be: “How much will my monthly payment be?”

Of course, we have our automotive financing calculator, just for that purpose.

Here's how it works: We factor in the vehicle price, trade value, trade payoff, down payment, APR, and loan term. Together, these elements determine your estimated monthly payment, giving you a better idea of how to budget for your loan.

Vehicle Price: The Starting Point

This is the base number from which the rest of the financial factors will be calculated. When shopping used, you aren’t always guaranteed a price upfront, but, luckily we do things differently at CarShop. Our haggle-free, hassle-free price is always listed right up front, so you know where to start.

Trade Value: Get Credit for Your Existing Vehicle

If you have a vehicle that you’re planning to trade in, the trade value can reduce the amount that you need to finance. The amount your vehicle is worth will be appraised by a CarShop professional, but you can start the process by getting an online estimate backed by Kelley Blue Book here.

Trade Payoff & Equity: What You Owe on Your Trade-In

Sometimes, you might owe more on your current vehicle than its trade value. This is where the trade-off comes into play. The trade-off is the remaining balance on your current car loan. If your trade-in is worth $10,000 but you still owe $12,000 on it, the trade-off is $12,000.

In this case, instead of reducing the amount you owe on the new vehicle, you’ll need to add the difference (in this example $2,000) to your new loan balance.

In an automotive financing calculator, the trade payoff is subtracted from the trade value to create the trade equity value. If your trade payoff exceeds the trade value, that trade equity will be negative, which may require you to bring additional money to the table to cover the difference or roll that amount into your new loan (which would increase your monthly payment).

Down Payment: Your Upfront Contribution

The down payment is the amount of cash you contribute upfront toward the purchase of your vehicle. A larger down payment reduces the amount you need to borrow, which can lower both your monthly payment and the overall cost of your loan.

The amount you put down will be deducted from the vehicle's adjusted price after the trade-in and trade payoff values are calculated.

APR: The Cost of Borrowing

The Annual Percentage Rate (APR) is the interest rate you’ll be charged on the loan. It’s essentially the cost of borrowing money from the lender and varies based on factors like your credit score and loan term.

The APR is a factor in determining your monthly payment and the interest you’ll accrue over the loan's term. A lower APR means lower interest charges, making the loan more affordable.

Loan Term: The Duration of Your Loan

The loan term is the length of time you’ll have to repay your loan and is typically expressed in months. With CarShop’s automotive financing calculator, you have options for shorter loans like 24 or 36 months, all the way up to longer loans of up to 84 months.

The loan term is critical for determining your monthly payments because it determines how much time you can expect to spread the loan out over. Shorter-term loans result in higher monthly payments, but ultimately lower interest costs because you’re paying off the loan quickly. Longer-term loans will have lower monthly payments, but you’ll pay more in interest over the life of the loan.

Putting It All Together

Now that we’ve covered each of these key elements, let’s see how they all come together to calculate your monthly payment.

1. Vehicle Price: This is the total price of the car.

2. Trade Value: Subtract any trade-in value from the vehicle price.

3. Trade Payoff: Add any remaining balance on your trade-in loan if it exceeds the trade value.

4. Down Payment: Subtract the down payment from the adjusted price (after trade-in and trade payoff).

5. APR: Factor in the APR to determine the cost of borrowing.

6. Loan Term: Apply the loan term to calculate the monthly payments over the loan’s duration.

By using our automotive financing calculator, you can better visualize how these different factors affect your payment and confidently plan for your financial future.

Happy car shopping!